The Great Resignation & Banking Tech

A look at the recent impact of the Great Resignation on technology in the investment banking sector with a deeper look at the impact caused by stagnating wages and increasing competition from the big technology (FAANG).

In all likelihood, you’ve already heard of the phenomenon being labelled as the Great Resignation. I won’t even attempt to provide a generalised explanation for this, and, even in the narrower context of the technology industry, a great deal has been written about this already. What I haven’t seen discussed a great deal, however, is the impact on the sub-sector that is technology in investment banking (and in particular in the UK, which is where most of my experience lies).

It doesn’t take much digging, however, to see that, at least in the case of tech workers, the Great Resignation is less about quitting their jobs completely and more about moving jobs for a raise. Often a very large raise.

While the Great Resignation is primarily talked about as a US occurrence, there is little doubt that, in much the same way that if America sneezes the rest of the world catches a cold, it has had an impact that is far wider than just the USA. If you’re a hiring manager working in investment banking technology, I’d be pretty surprised to hear if you haven’t had a hard time both retaining and hiring staff in 2021, irrespective of where in the world you’re located. I can certainly vouch that our clients and many other colleagues I speak to are impacted in this way. A recent post on LinkedIn certainly seemed to illustrate the impact of the “Great Move Jobs For a Large Pay Rise” (not quite as catchy as The Great Resignation is it) in action in the UK.

So, nothing to see here folks, the impact of the Great Resignation on the investment banking tech sector is the same as that anywhere else in technology. Case closed, move on please.

Almost, but not quite. Certainly, it has become harder to retain good engineers in 2021, but you wouldn’t have to look far to find a hiring manager (in investment banking tech) that will tell you that finding good engineers has been difficult for far longer. For at least five years if not perhaps getting on for 10. So, whilst the Great Resignation may be accelerating things, something else that has been happening a lot longer seems to be at play.

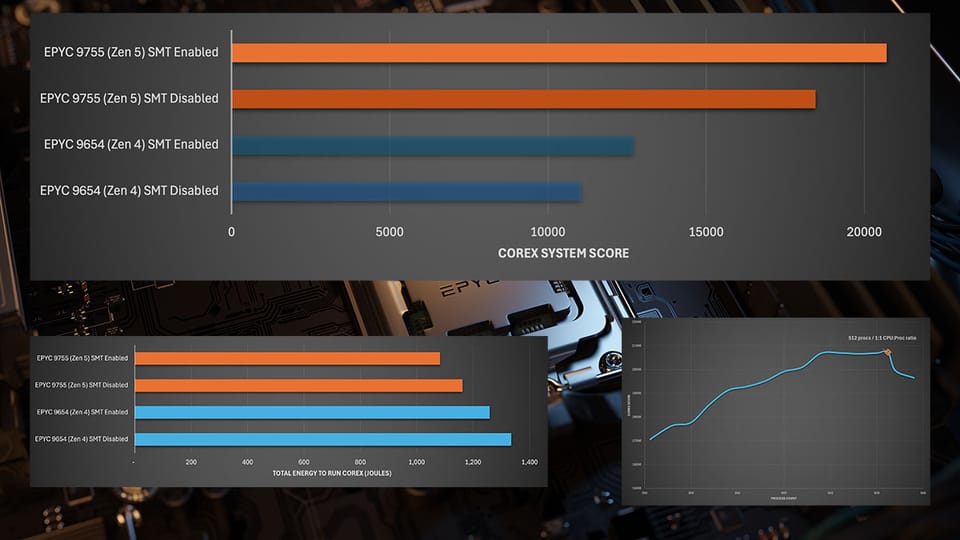

I recently I came across an article by The Pragmatic Engineer. In his post, The Trimodal Nature of Software Engineering Salaries, he posits (quite successfully in my opinion and I would encourage you to read the whole article) that tech employers can be split into three categories or tiers.

- Tier 1: Non tech firms. Salaries compared regionally to other firms in the same industry. Tech seen as a cost centre. Salary N.

- Tier 2: Tech and non tech firms. Salaries compared regionally to all other employers of the same skills. Salary 2N including bonus.

- Tier 3: Tech firms. Salaries compared globally to all other employers of the same skills. Salary 3 to 5N including bonus and stock options

What’s really interesting about this is where investment banking technology fits into these tiers (Gergely talks about this a little himself), and, more critically, how that has changed and is still changing over time.

The decline of banking technology salaries

When I first started working in this sector, over 20 years ago, investment banking technology was without question not only in tier 3, but also where you would find world-leading technology (though it was probably hidden behind closed doors). Phrases such as golden handcuffs (a remuneration structure that vested over time to dissuade employees from leaving and golden handshakes (signing on bonuses) were in common parlance and bonuses of over 50% of the base salary were common even for junior hires (who performed well). Correspondingly though, there was also a culture of being able to lose your job quickly if the expected levels of performance weren’t displayed. Even I, as an inexperienced developer, a mere two years out of university, more than doubled my salary by moving from an aerospace engineering firm into banking (technology).

However, the last twenty years haven’t been particularly kind to this sector and the environment I describe above would sound completely alien to anyone joining banking technology today.

The hard truth is that salaries have been slowly stagnating and bonus payments have shrivelled and, whilst the industry still operates on the same principles and practices it used to, the actual payments are often so trivial as to be largely meaningless. The annual bonus meetings with your manager are mostly just theatrics at this point. This has been coupled with an increasing desire to migrate technology to lower cost regions (contrast this with hiring practices in big tech firms today). Overall though, salaries still remain above other non-tech firms, meaning banking tech has slowly (and probably unwittingly) slipped from tier 3 into tier 2.

There seems to be little sign of this abating and, in some ways, even today, banks are firmly in the tier 1 category. Despite the often grandiose statements expounded by banking C suite executives, the reality is that technology is very much seen as a cost centre and treated as such. Instead of providing employees with best in class hardware, they are often hamstrung by substandard ageing machines. Instead of paying for the best tools and software to develop with, employees can often be seen using community editions of development environments instead or paying for their own personal licenses. (I should state for clarity here that I am excluding the microcosm that is quants, which is a topic that needs an article of its own).

In my own time of working in this industry, I have gone from having a SUN workstation and a dual CPU Windows machine at a desk with three widescreen LCD monitors (at a point in time where a single LCD monitor was a novelty) to having a shared desk, with a single poorly specced virtual machine. I’ve gone from having access to a complete MSDN subscription and access to almost any development tooling you could think of (though there was far less choice then) to being reduced to using Visual Studio Code and community editions of other IDEs (when forced to work within the confines of my client’s networks).

These are signs of banking continuing its slide to becoming firmly a tier 1 employer. If salaries continue to stagnate the way they have, without doubt it is only a matter of a time before that is a reality, and the Great Resignation and current rates of inflation will only serve to accelerate this.

Of course these are all generalisations across the industry and there are outliers, as is well illustrated by this LinkedIn post.

In the last five years, I have seen many of my colleagues and clients move to big tech firms instead, especially as these companies set up in London and other European cities or start hiring for fully remote roles from the USA. This shift in talent is having a very marked effect.

The impact on banking software

The progressive move from tier 3 to tier 2 (and maybe tier 1 to some degree) naturally comes at a cost (though the bean counters may well be seeing costs saved).

Over the last twenty years, I have gone from working with some of the best people in the tech industry anywhere to working in organisations that struggle to deliver CRUD REST API applications. I have gone from writing world class applications that were in some cases sold outside to technology vendors to being unable to hire developers that are able to pass the most basic of written tech tests.

Now, I fully acknowledge there are other factors in play here too, and they will be the topic of another article for another day, but the impact of the slide from tier 3 to tier 2 cannot be underestimated.

Sadly, for the banking industry, investment banks are large and complex organisations that have large and, in some areas, technically complex code bases, such as high frequency and algorithmic trading systems, and large scale risk systems both for internal front office risk and for back office and regulatory risk reporting. Much of this code has already been written, but asking for it to be maintained in future at tier 1 costs when it first took tier 3 developers to write it is a disaster waiting to happen.

The Dead Sea effect is very visible within investment banking technology and I fear is likely only to accelerate in light of recent developments.

It is when viewed through this lens that the current mass migration to cloud providers (and services) arises, and even when this appears to be commercially disadvantageous (most HPC workloads are far cheaper to run in-house than cloud hosted for example, often by as much as half the cost). I can only assume the idea is to move from proprietary code that they can no longer afford to pay developers tier 3 rates so as to maintain commoditised services provided by the large cloud providers. Or maybe that’s wishful thinking and no one has actually put that much though into this problem yet (which is more likely to be the truth).

Looking to the cloud for a saviour seems a little dangerous. While the fin techs have been snapping at the heels of banking, the great white that is AWS is more likely to tear off its legs. I see little reason to believe that Amazon (as one example) wouldn’t employ the same business practices it has in Amazon Marketplace and AWS to glean larger insights into the investment banking business and respond accordingly.

Of course, if you do find yourself in a tight spot, we’ll always be happy to come and help. You know where to find us :)